Prof. Victor Murinde’s Chapter Contributions featured in a book titled “Inclusive Financial Development

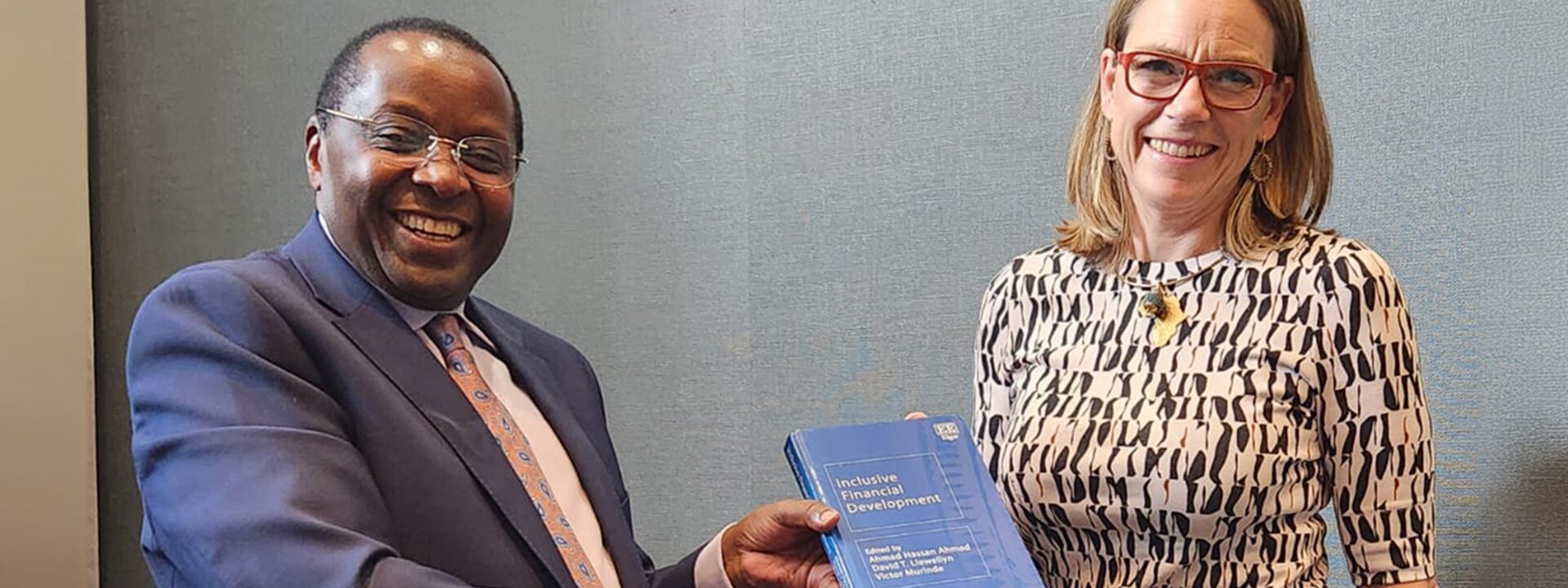

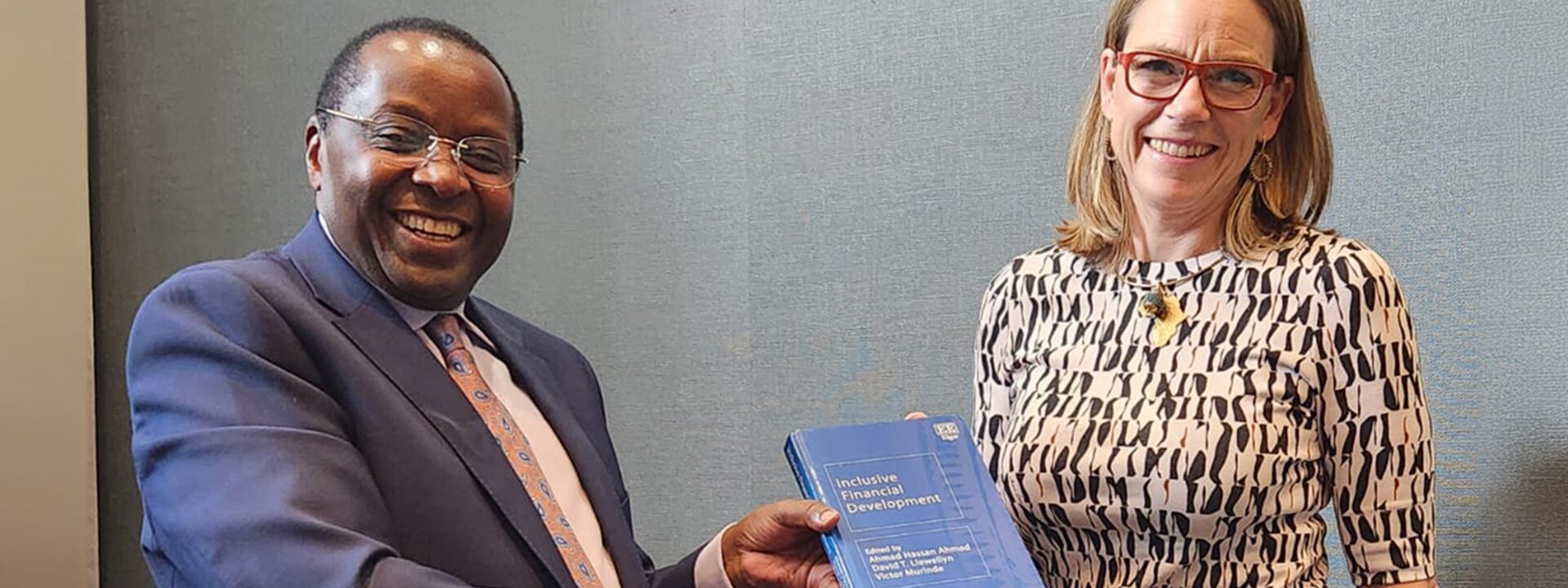

July 12, 2024Prof. Victor Murinde, AERC Executive Director recently gifted Ms. Erin Tansey, IDRC Director for Sustainable Inclusive Economies (SIE) an edited book volume titled “Inclusive Financial Development” in which he contributed three chapters. Ms. Tansey who was visiting Nairobi from Ottawa, Canada to engage AERC on future collaborations was delighted to receive the intellectually stimulating book.

Inclusive Financial Development edited by Ahmad H. Ahmad, David T. Llewellyn and Victor Murinde was published by Edward Elgar Publishing. It provides theoretical and empirical analyses of the nature of financial inclusion. The contributing authors explore the impediments to inclusion that exist around the world, the macro and stability implications, and the regulation dimension.

Chapter 5 of this book on “The impact of financial inclusion on sectoral economic growth” is authored by Victor Murinde, Ayse Demir, Joseph Ajefu and Syed Bukhari. This chapter observes that in a panel of 69 countries covering the period 2004-2017, the impact of financial inclusion on agricultural, industrial and service sectoral growth appears to change depending on the financial structure of the country. It has comparative advantage in promoting agricultural growth in countries with financial systems dominated by markets, while its effects are stronger on services and industry growth in countries with market-based financial systems.

Then again Prof. Victor Murinde contributes to Chapter 7 of the volume titled “The rise of cross-border pan-African banks in the WAEMU”. This chapter is authored by Victor Murinde, Issouf Soumara and Kouama Dasira Kanga. It reviews the recent trend of pan-African banks presence in the West African Economic and Monetary Union (WAEMU) region. The chapter notes that the proportion of foreign banks grew from 63% in 2000 to 79.5% in 2017, and the share of cross-border pan-African banks rose from 29% in 2000 to 62% in 2017.

The ownership structure of the banking sector is changing fast, implying changes in the structure of the banking sector in terms of competition, lending and stability. This chapter similarly shows how the increasing cross-border pan-African banks activities in the regional countries has improved competition within the banking sector, while at the same time, it has increased access to bank loans. The current rise of pan-African banks has different policy implications. This trend can be sustained by investing in new technologies which enable banks to go digital. Policy makers and regulators should also be sensitive to the need to promote the use of new technologies which are necessary to improve the efficiency of pan-African banks and to reduce intermediation costs.

In the concluding chapter where Prof. Murinde is featured again describes the main aspects of inclusive financial development covered in the book. It summarizes the research findings, policy implications and direction for future research. The chapter delivers six key messages. First, emphasis is made on the role of financial regulation in financial inclusion, to entrench trust and confidence in financial institutions, ensure systemic stability and consumer protection.

Second, they endorse the strong empirical evidence, which shows that financial inclusion has been greatly improved by the adoption of digital finance, especially in Africa where the financial access gap has been very wide; appropriate policy and interventions are urgently required to scale up interoperability of retail electronic payments platforms and provision of electronic-ID system.

Third, there is robust evidence that financial inclusion promotes economic growth, notably more in agriculture and services than other sectors of the economy; this solid evidence is timely for government intervention in the two sectors where households and companies are most active and where participation opportunities are greater for and women entrepreneurs and start-ups by the youth.

Fourth, the rise of the pan-African cross-border banking revolution has improved competition within the banking sector, which in turn has increased access to bank loans for households and businesses. Fifth, mobile money – the most elementary form of FinTech which started in Africa and is diffusing rapidly worldwide – has become part of the financial system in several African countries and has disrupted the well-entrenched digital divide between the North and the South.

Sixth and finally, there are still several challenges to achieving inclusive financial development including infrastructure, internet security, and lack of incentive compatibility between government actors and private sector agents; they highlight future research to address these challenges and generate new evidence to guide new policies and practices to enhance inclusive financial development and growth.

“Here is the inside of my brain” Prof. Victor Murinde, AERC Executive Director seems to say while gifting a book titled Inclusive Financial Development to Ms. Erin Tansey, IDRC Director for Sustainable Inclusive Economies (SIE).