Pioneering the FinTech Revolution in Africa: Insights and Innovations (AERC)

December 1, 2024The African Economic Research Consortium (AERC), in partnership with the Central Bank of Kenya (CBK), is holding its 61st Biannual Plenary Session at the Glee Hotel in Nairobi. This year’s session focuses on The FinTech Revolution in Africa, underscoring Africa’s crucial role in global financial innovation and its potential for inclusive growth and economic transformation.

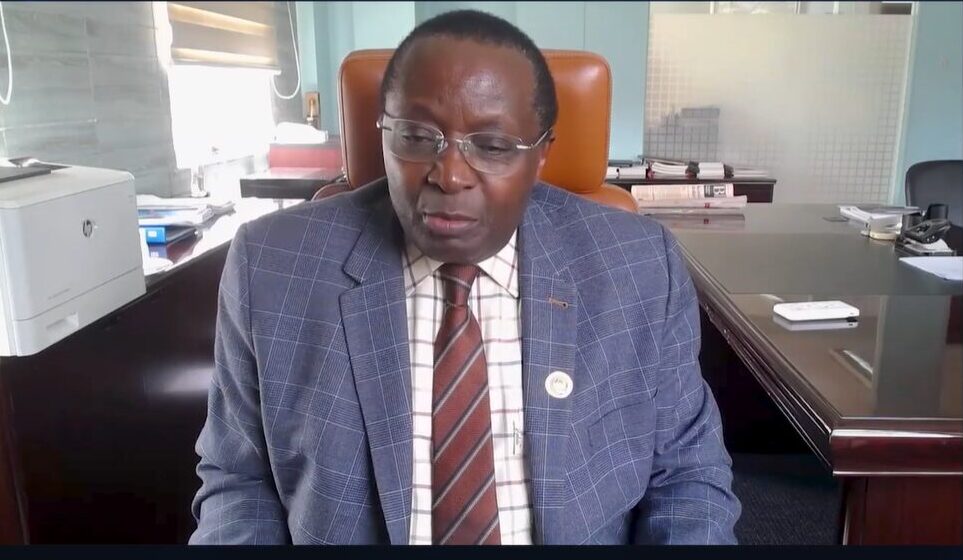

The event was inaugurated by Central Bank of Kenya, (CBK) Governor Dr. Kamau Thugge, on Sunday, December 1st, who emphasized the importance of central bank leadership in navigating Africa’s evolving financial technology landscape both in Kenya and around the continent.

Dr. Thugge also emphasized the importance of the groundbreaking mobile money services in Kenya noting it has provided room for financial inclusion and paved the way for further innovations surrounding financial services.

“The government of Kenya has prioritised digitisation and key economic strategies under the bottom-up economic transformation agenda, underscoring the benefits of adopting digital technologies among various sectors,” Dr. Thugge noted.

According to a report by professional services firm BDO titled Unlocked Potential: FinTech in Africa, the continent’s FinTech market is projected to grow thirteenfold to US$65 billion by 2030, with a compound annual growth rate (CAGR) of 32%. This growth is led by ‘mobile money, a ubiquitous solution for the unbanked in Africa, enabling seamless transfers and payments.

Speaking during the plenary sessions, Credit Bank Chief Executive Officer, Mrs. Betty Korir lauded Credit banks strides in digitising it’s services, noting that to date, 89% of bank services are carried out outside the bank. In this digitisation era, lending platforms are also leveraging alternative data to offer financial products to underserved populations.

Mrs. Korir also noted that a recent amendment to the Central Bank of Kenya (CBK) banking act of 2021 has further accelerated this shift, bringing together various players in the financial sector to foster a more inclusive and efficient banking environment.

The Credit bank CEO however said that the regulatory change has been met with mixed reactions, but the overall trend points towards a more integrated and technologically advanced banking sector. Credit Bank has been particularly proactive in adopting FinTech solutions and that move has not only enhanced the bank’s operational efficiency but also ensures a higher level of security and compliance.

The 61st AERC Biannual Plenary Session promises to be an insightful event, shedding light on the transformative potential of FinTech in Africa and fostering dialogue on the future of financial services on the continent.

With Africa emerging as a global leader in digital financial solutions, AERC, through this far reaching event, is stepping up to share insights and strategies that will drive financial inclusion and resilience across the continent.

Source: Daily Monitor

By Edwin Austin on December 1st 2024