AERC Stakeholder’s Engagement Workshop on “Reforming the Tax Policy and Institutional Measures for Kenya”

March 12, 2024The African Economic Research Consortium (AERC) in collaboration with the Kenya Government with support from the Royal Danish Embassy recently hosted a stakeholder’s engagement workshop on “Reforming the Tax Policy and Institutional Measures for Kenya”. The meeting was held on March 8, 2024, at the Mercure Hotel, Nairobi, Kenya.

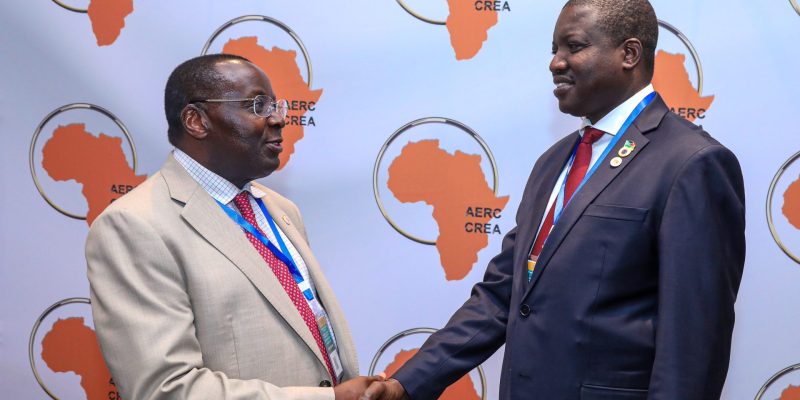

In his welcoming remarks, Prof. Dominique Njinkeu, Interim Executive Director, AERC noted that AERC has several vehicles through which it shares its research outputs; and one is by way of organizing dissemination activities including policy workshops such as this one to engage stakeholders. The meeting was chaired by Dr. Rose Ngugi, Executive Director, Kenya Institute for Public Policy Research and Analysis (KIPPRA).

The Kenya Revenue Authority (KRA) Commissioner General, Humphrey W. Mulongo, in his opening remarks noted that they have engaged other institutions on similar research projects. He stressed on the need for understanding reform administration of value added tax (VAT) and personal income tax, adding that it is imperative to come up with tangible tax policy proposals that can be included in the next budget. He made a commitment to collaborate with research institutes to improve evidence policy decision making in Kenya.

Hon. Prof. Njuguna Ndung’u, Cabinet Secretary, National Treasury, Kenya who delivered the keynote speech said that negative shocks have ravaged most African economies, however, a good number of them are now on a recovery trajectory. He laid emphasis on ways and means of optimizing revenue without compromising on compliance. He said that the cost of living has been the talk of the day in Kenya, thus, this studies are timely and an easier way to try to address some of the issue we have in the country.

“We really need to know what is at play and where the weaknesses are; because if we are not well informed we cannot make optimal decisions to protect consumers in different categories,” said Prof. Njuguna Ndung’u.

This project was supported by the Royal Danish Embassy in Nairobi and AERC in partnership with a series of Kenyan partners and buoyed by the Development Economics Research Group at the University of Copenhagen (UCPH-DERG). The venture is undertaking collaborative research project to support “home-grown” Economic Research and Policy Making in Kenya (ERPMK).

The objective of the research collaboration is to generate high-quality research, to enhance understanding of the tax policy in place and its impact, and to review the optimal tax measures required to support a large tax base consistent with expenditure requirements while at the same time ensuring equity and market development.

Thus, the research will generate evidence-based policy in relation to structure of tax policy, tax policy instruments and the ideal fiscal policy framework. This will support a re-designing of Kenya’s tax policy to ensure that tax revenue measures and compliance are consistent with Bottom-Up Economic Transformation Agenda (BETA) development goals.

This workshop therefore focused on the tax related instruments and tax reform measures and how to optimize them to generate revenue in an equitable and cost-effective way. The stakeholder’s workshop brought together key stakeholders from relevant institutions who have important roles to play in shaping new research findings, paving new policy directions, and initiating innovative practices in the focus areas.