AERC-CGF-ODI Conference 2024 on China-Africa Economic Interactions: Past, Present, and Future

September 13, 2024The African Economic Research Consortium (AERC), the School of Oriental and African Studies (SOAS) Centre for Global Finance, and the Overseas Development Institute (ODI) co-hosted a major conference on China-Africa Economic Interactions. The event which took place in London, United Kingdom on 12-13 September 2024, brought together researchers, policy makers and practitioners to discuss issues surrounding the China-Africa economic interactions through the lens of China’s infrastructure investment.

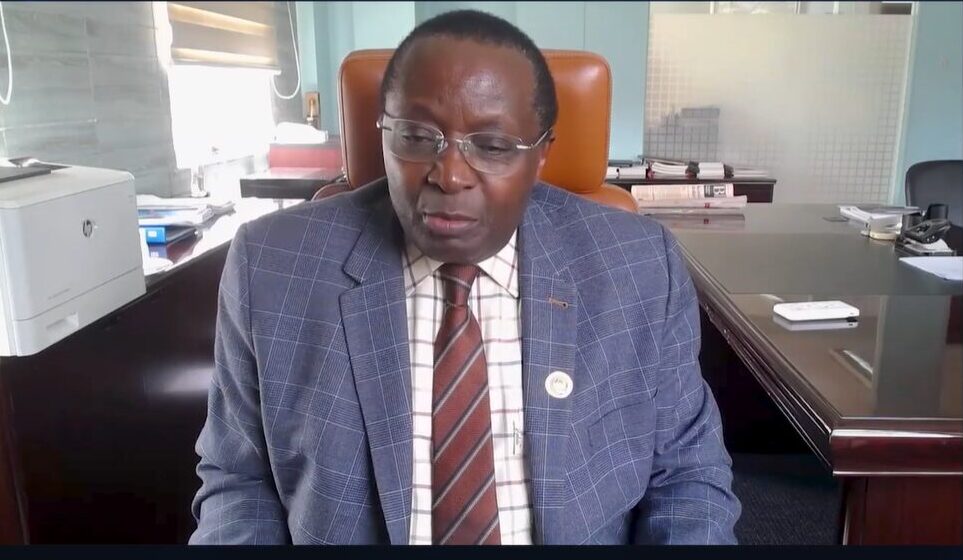

Prof. Victor Murinde, AERC Executive Director chaired the Keynote Speech I session on “Do Chinese firms benefit from undertaking China’s overseas infrastructure investment?”. The speaker was Professor Franklin Allen, Interim Dean of Imperial College Business School. The official opening session chair was Prof. Hong Bo, AXA Chair in Global Finance & Director, Centre for Global Finance, SOAS University of London. The Welcome address was by Prof. Elisa Van Waeyenberge, Head of College of Development, Economics and Finance (CoDEF), SOAS University of London and the Opening remarks by Prof. Dirk Willem te Velde, Director of the International Development Group and the Principal Research Fellow, ODI London.

The discussions covered various issues including China’s infrastructure investment in Africa, which is now immense. It is important to note that in 2005, only four African countries received infrastructure investment from China, while by 2023, this figure had risen to forty-six. The high growth of China’s infrastructure investment in Africa in the past two decades is primarily attributed to the pre-Covid period (61.45% from 2005-2019). However, we have seen a decline in this investment (-23.49% from 2020-2023) due to ongoing adjustment of China’s model of operating overseas infrastructure investment since Covid-19.

Prof. Murinde said that this conference was crucial because of the in-depth analysis and insightful discussions. “We delved into the implications of China’s infrastructure investment for Africa’s development trajectory, and I am delighted that leading researchers, policymakers and practitioners were able to explore the evolving dynamics of China-Africa economic interactions”.

Following a significant increase in trade and finance between China and Africa since the early 2000s, Chinese economic engagement in Africa (trade, investment, lending) is now showing signs of slowing down. Chinese foreign direct investment (FDI) and lending to Africa have plateaued in the last five years, while the second phase of the Belt and Road Initiative (BRI 2.0) has shifted towards a more cautious approach. Simultaneously, debt distress faced by many African countries is influencing their relations with China.

However, initiatives like the African Continental Free Trade Area (AfCFTA), which is reshaping Africa’s economic transformation, present new opportunities for future engagement with China. In the wake of the 2024 Forum on China-Africa Cooperation (FOCAC), there was a high-level roundtable panel on Trade, finance and debt between China and Africa: new policy approaches or more of the same? during the event that explored the evolving policy landscape in relation to China-Africa economic relations, focusing on potential shifts in policy directions concerning trade, finance, and debt. The panel explored the factors driving these changes, analyzing their implications for both China and Africa and discussed potential pathways towards a more balanced and sustainable economic partnership.

Session VI, which came towards the end of the event was reserved for AERC Roundtable Discussion on China in Africa. The chair of this session was Prof. Peter Muriu, Associate Professor of Economics and Finance, University of Nairobi and the panelist included Prof. Victor Murinde, Executive Director, AERC, Dr Abbi Kedir, Director of Research, AERC, Dr Dianah Muchai, Research Manager, AERC, and Ms. Patricia Ojangole, Managing Director, Uganda Development Bank.

The conference examined the impact of the decline in China’s infrastructure investment on African economies, explored the evolving strategies of Chinese investors in the post-COVID era, assessed the role of geopolitics in shaping China-Africa economic interactions and identified opportunities for sustainable and mutually beneficial partnerships.